We offer alternative returns

Our focus is to offer an attractive long-term alternative to fixed income. Our flagship fund, Ress Life investments, has a 13-year track record of delivering dependable absolute returns with a low volatility

Attractive risk-adjusted return

The net annualised return is approx. 6.0% in US dollars in the last ten years.

Capital preservation

Over 70% of monthly returns are positive. Volatility in the last ten years has been in the range of 3-4%.

Risk diversification

Returns are uncorrelated, which makes the strategy attractive for investors seeking risk diversification.

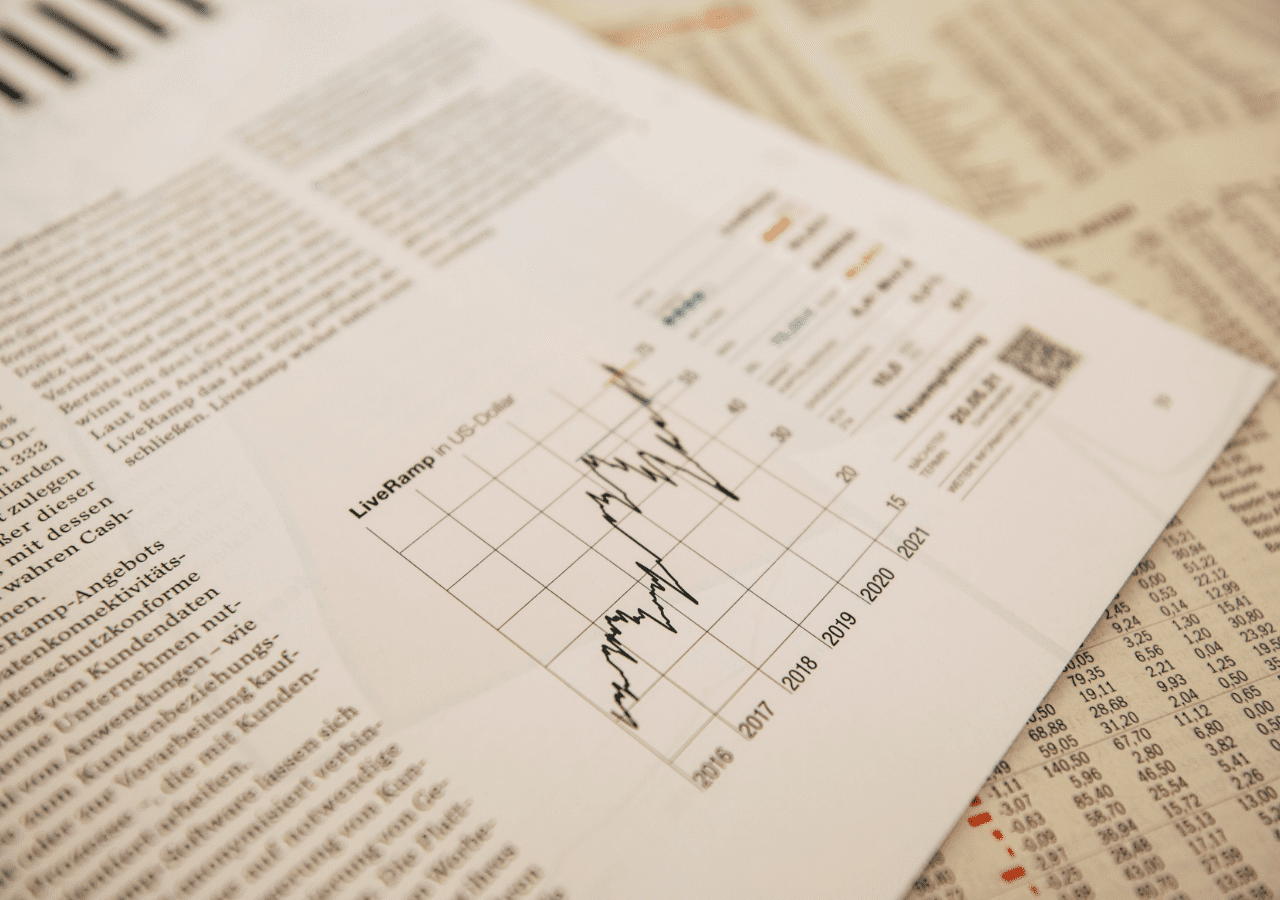

Exchange-traded

The company is listed at Nasdaq OMX Nordic and the market-maker, Carnegie Bank, provides daily prices.

ABOUT RESS CAPITAL

We are an alternative investment fund manager

As an AIFM, we are authorised and regulated by the Swedish Financial Services Authority

The Fund

We invest in the secondary market for US life insurance policies

We offer investors both risk diversification and attractive returns. The main risk in this asset class is uncorrelated to most other asset classes

Performance

The fund aims to deliver

attractive risk-adjusted returns

Strategy

The strategy offers risk diversification and attractive long term performance

NEWS

Ress Capital merges with Finserve Nordic

We are pleased to announce that Resscapial AB is merging with Finserve Nordic AB and

Ress Life Rotates Portfolio to Capitalize on Repricing

By: Eugeniu Guzun, Hedge Nordic Discount rates in the U.S. life settlement market have increased

Ress Life Investments wins second place for “Best Nordic Diversified Hedge Fund 2024”

We are pleased to announce that Ress Life Investments won second prize in the category

Marketing de-notification for Croatia and Slovenia

As of 7 April 2025, Resscapital AB has made a de-notification of arrangements made for